Explained: reporting incapacity for work

Reporting incapacity for work

Reporting incapacity for work? Don’t worry, we’ll take care of most of the process. First, your employer will inform us, so you won’t have to take the first step. As soon as your employer has notified our team, you’ll receive a health information file from us for completion. Once you’ve provided the requested information, we’ll open your claim file and make sure it’s processed as quickly as possible. Together with the insurer’s physician advisor, we’ll assess whether you’re eligible for an additional allowance on top of your statutory income replacement benefits.

Do you meet the conditions for extra benefits under the Income Care plan? Then we’ll calculate your allowance. The amount depends on the terms of your guaranteed income insurance plan and the physician advisor’s assessment, which determines the incapacity percentage and the duration of your payout period.

Next, we’ll pay out your additional benefits. We’ll also notify you in writing, so you know exactly what amount to expect, when the payments will begin, and how long they will last.

Please note: Additional benefits are always taxable. We’ll withhold part of the tax in advance. The remaining amount must be declared in your personal income tax return, just like your salary.

Income Care

Starting a file

Declaration bundle

You do not have to take the initiative for this yourself. As soon as your employer informs us of your incapacity for work, you will receive a declaration bundle from us. We will also ensure the smooth and rapid processing of your personal file.

Preparation

Once we have received all the information from you, we compile your personal claim file. In consultation with the insurer's doctor, we determine whether you are eligible for an extra benefit on top of that provided by the health insurance fund.

Benefit calculation

Do you meet the necessary conditions to be entitled to an additional benefit through the Guaranteed Income plan? Then we will calculate what additional benefit will be paid.

For this, we always base ourselves on the ground rules of the Guaranteed Income plan and the advice of the insurer's doctor (both for the percentage of disability and for the payout period).

Disbursement

Finally, we pay the additional benefit and notify you in writing. That way, you know ready and clear what amount you can expect when.

That additional benefit, like your salary, is subject to taxes. Part of this tax is already withheld by us. The remaining part you will have to declare through your personal income tax.

Through a tax sheet, we inform you of the exact amount involved.

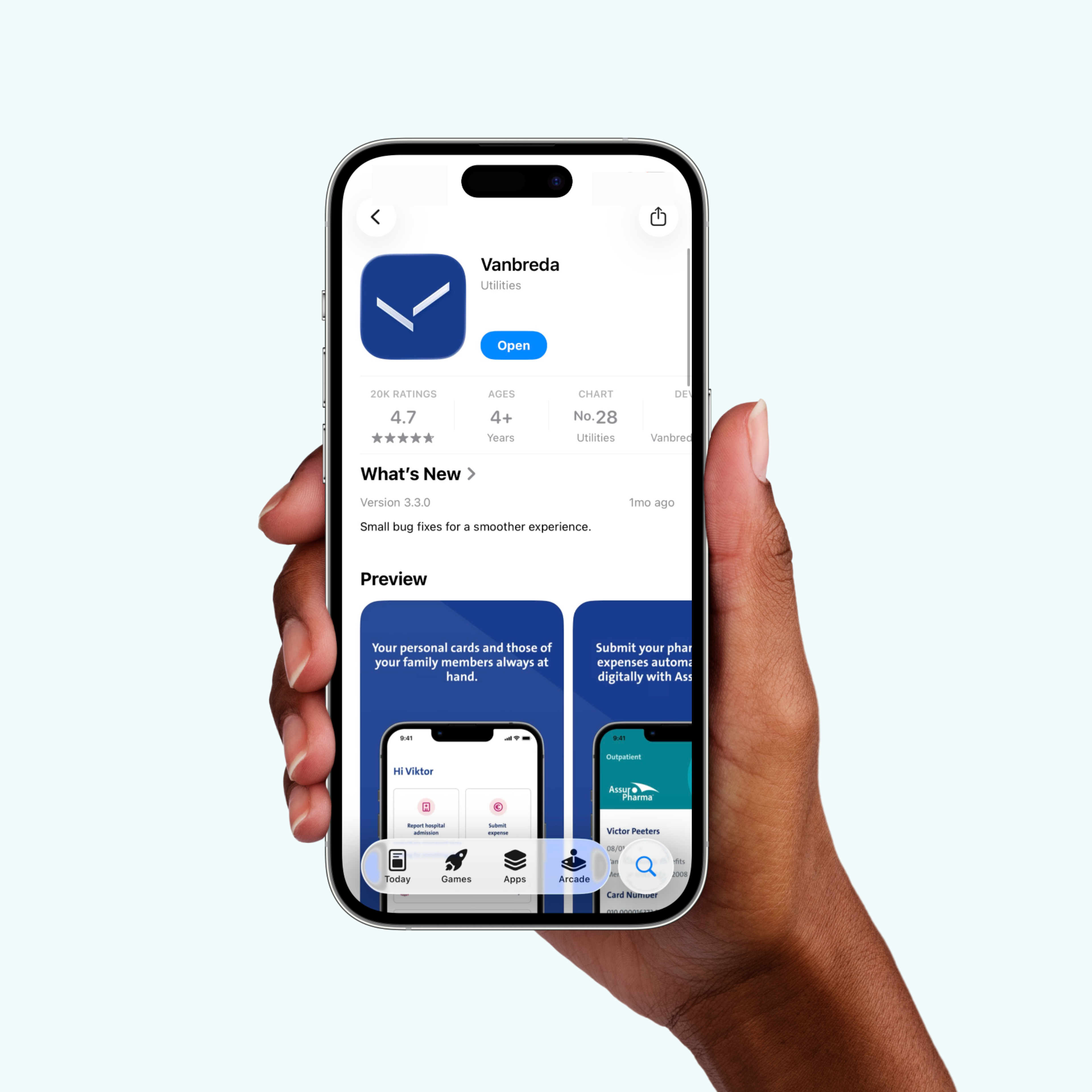

Vanbreda App

Answer all your questions with the app

Vanbreda App

With the Vanbreda App, you can easily keep track of your health insurance information. Have you already received your health record documentation? You can report incapacity for work directly via the app. You can also request your policy terms and conditions, update your bank details and much more. Any further questions? Just get in touch directly with our team through the app.

Frequently Asked Questions

Show allIncapacitated for work

By pre-existing disorders we mean any illness, accident, pregnancy and delivery that occurred prior to the date of affiliation or whose first objective symptoms appeared prior to that date.

We cannot grant a benefit if the disorder or incapacity for work for which you wish to claim your insurance was diagnosed or stated prior to your affiliation. In case of a disorder or accident, we nevertheless take into account the worsening of your disorder or increase of your degree of incapacity for work when you are affiliated for more than a year and have not been unfit for work during that period due to this pre-existing disorder.

This means that you will not receive a benefit in case of illness or incapacity for work during the first year of affiliation due to a pre-existing disorder.

It is the period during which your guaranteed income insurance does not provide coverage yet. This insurance can only be activated as soon as the waiting period has expired. The length of this period depends on the conditions of your insurance policy.

At that moment you are no longer covered by the system of temporary lay-off. Because when you fall ill during a period of temporary lay-off, you receive an allowance from your mutuality. As far as your guaranteed income insurance is concerned, the waiting period will start at the beginning of your incapacity for work. After this waiting period you can submit your file to us.

Does your incapacity for work last longer than initially expected? Or did you get back to work earlier? Vanbreda Risk & Benefits receives all relevant information about resumption of work or prolongation of incapacity for work directly from your employer. Of course you too can keep us informed of all relevant changes of your situation, for instance when you resume work earlier. This avoids that Vanbreda Risk & Benefits wrongfully pays out amounts that you should pay back afterwards.