What to do in case of serious illness?

We support you step by step, to help you through difficult moments.

In detail

How do you report a serious illness?

Report your serious illness as soon as possible via the app or web portal. To submit a valid report, you will need a medical statement from your treating physician. This statement must include either a confirmation of the condition or a formal diagnosis.

Additionally, your doctor should provide details of any procedures already carried out and any planned treatments. Simply upload your doctor’s medical report when submitting your serious illness report online. Our physician advisor will then review your information to process the documents you’ve submitted.

You can track the status of your file online, and we’ll notify you as soon as possible whether your illness is covered by your insurance plan. Coverage depends on the individual terms and conditions of your policy.

Costs

Which expenses are covered for a serious illness?

What expenses are covered in the event of a serious illness?

Outpatient costs directly related to your serious illness may qualify for reimbursement, depending on your policy terms. Typical examples include medical treatments and certain forms of outpatient care, such as doctor’s visits, prescribed medication, nursing care or physiotherapy.

How far back can you submit expenses?

We can open your file as soon as you receive a diagnosis or once your insurance plan becomes active.

The maximum statutory period for submitting and reimbursing your incurred costs is three years. We cannot process expenses incurred more than three years ago.

Disorders

Want to check straight away if your condition is covered by your insurance policy?

Request your individual policy terms via the app or web portal.

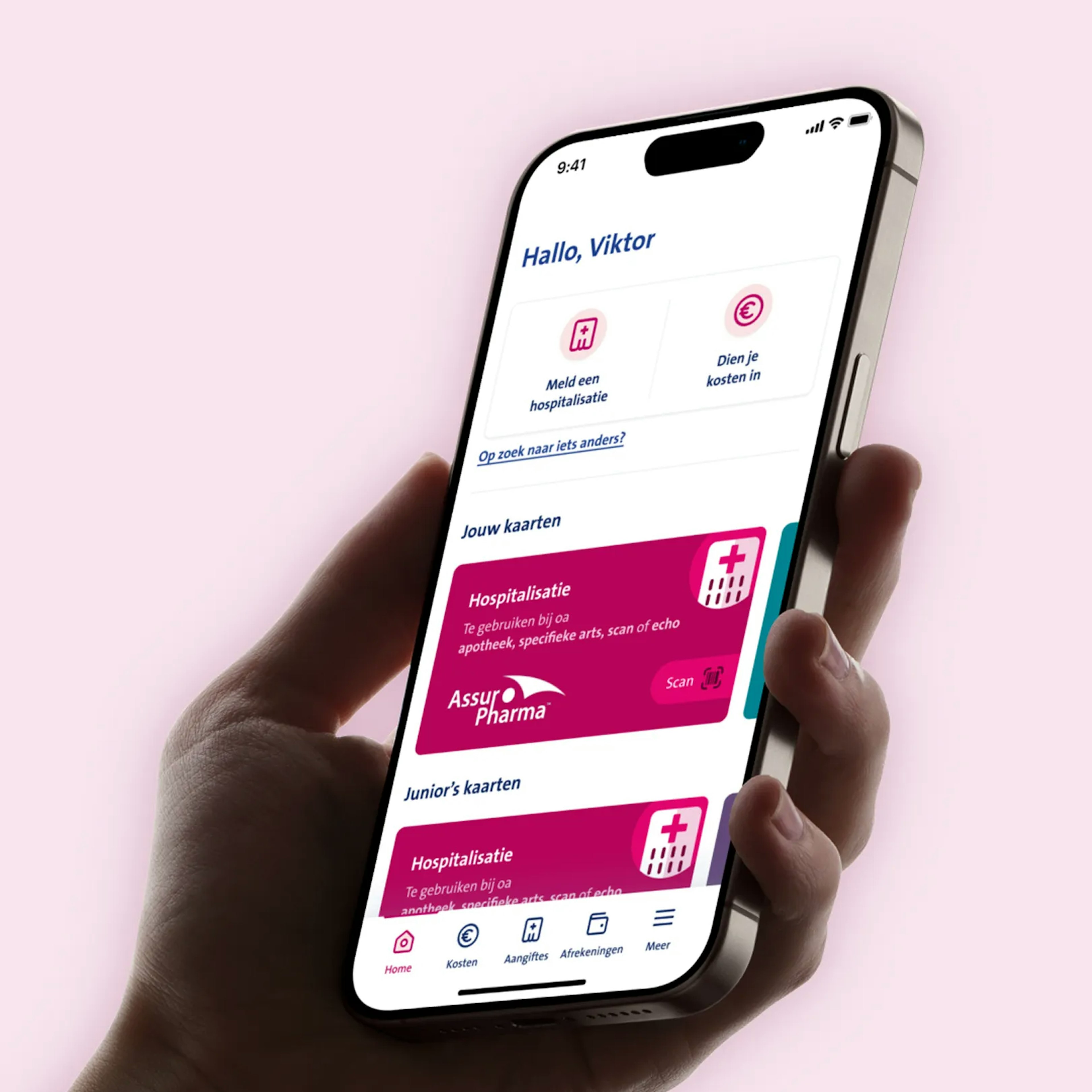

Your cards always on file, online

One app for your 010 number and AssurPharma barcode

Medi-Link

Thanks to the Medi-Link third-party payment scheme, your hospital bill is sent directly to Vanbreda as soon as you file your hospitalisation report. Medi-Link allows us to settle your bill directly with the hospital. Always provide your 010 number when registering at the hospital. You can find this number in the Vanbreda App.

AssurPharma

AssurPharma is the service that handles reimbursement of medication in Belgium. Ask your pharmacist to scan your personal AssurPharma barcode when purchasing medicines. Your pharmacy receipts will then be sent to us automatically for reimbursement.

Vanbreda app

Frequently Asked Questions

Show allSerious Illness

Some serious disorders are defined as a 'serious illness' and are covered by the guarantee of serious illnesses of your policy. Most policies do have such a guarantee, but not all of them.

Therefore, check your policy to find out whether your policy contains a cover for serious illness and whether your serious illness is included in the list of illnesses to which this cover applies.

Your file will be running as long as treatments are needed, or until the end of your affiliation. In some cases, our medical adviser requests follow-up reports in order to further assess your file. In that case, we will keep you informed.

A serious illness remains covered as long as you still receive treatment for the same disorder, or until the end of your affiliation under this policy.

Follow-up

It is possible that our medical adviser asks for a follow-up report in order to stay informed about your file. In that case, we will keep you informed.

Reimbursement

Reimbursements in connection with your serious illness are always done according to the conditions of your policy.

A serious illness case can typically remain open for as long as you require treatment or until your insurance coverage ends. Our physician advisor may periodically request updated follow-up reports to reassess your case. We will always keep you informed of the status of your file.

Are you submitting your medical expenses online via the Vanbreda App or the web portal? Select the type of coverage that applies to your expense for smooth administrative processing and fast reimbursement.

Hospitalisation

Select the ‘Hospitalisation’ option in the app or web portal for all medical expenses related to a hospital stay. This includes, for example, your hospital bill, as well as costs incurred during the official pre- or post-admission period of your hospitalisation, such as medication, doctor’s visits and physiotherapy. Request your policy terms and conditions to check which costs are covered by your insurance plan and the duration of your official pre- and post-hospitalisation period.

Serious illness

Select the ‘Serious illness’ option in the app or web portal for all medical expenses related to a recognised serious illness (e.g. cancer or diabetes). Examples of related costs include medication, doctor’s visits, physiotherapy and care services. Request your policy terms and conditions to check which costs are covered by your insurance plan and which conditions are recognised as serious illnesses.

Outpatient care

Select the ‘Outpatient’ option in the app or web portal for all medical expenses that aren’t related to a hospital admission or a recognised serious illness. If you only have a hospitalisation plan with Vanbreda Health Care, outpatient expenses that are not related to hospitalisation or serious illness are typically not covered and do not need to be submitted. If you have an outpatient plan with Vanbreda Health Care, your insurance policy will reimburse certain outpatient expenses. Request your policy terms and conditions to see exactly which outpatient costs are covered by your insurance.

If so, file a separate online report for each serious illness, including the relevant medical reports.