Going to the hospital: what to do?

Five easy steps for a smooth hospital admission

Outpatient hospital admission

Same-day surgery

What is day-case surgery?

Not every hospital admission involves an overnight stay. Sometimes you can be released from the hospital on the same day as your procedure or treatment. You should report your hospital admission just as you would with any other hospitalisation.

How does day-case admission work?

Please notify us of your planned day surgery in advance. On the day of your procedure, provide your 010 number (Medi-Link) to the hospital. If you’re eligible for reimbursement under your policy, we’ll settle your bill directly with the hospital through the third-party payment scheme. We’ll always keep you informed of your claim status.

Multi-day hospital stay

Overnight admission

Which room type can I choose?

Are you staying in a single room during your hospitalisation? In that case, your hospital and treating physicians may charge additional fees or supplements. Your policy terms and conditions explain which room types are reimbursed during your hospital stay. Be sure to check which supplements are covered by your insurance, so you know exactly what to expect.

patient in hospital bed

Medical assistance outside Belgium

Hospital admission abroad

Do you or a family member suddenly become ill abroad?

Have you or a family member fallen ill unexpectedly while abroad? We’re here to ensure your hospital admission goes smoothly. Every Vanbreda hospital insurance policy includes limited coverage for medical expenses abroad. Do you also have assistance insurance via your employer through Assi-Link or Assi-Link+? Then you can benefit from additional services, such as supplementary assistance and repatriation.

Report your admission via the app or web portal as you would for a normal hospital stay in Belgium and select the option ‘hospital abroad’. If you are insured through Assi-Link or Assi-Link+, contact them immediately as well.

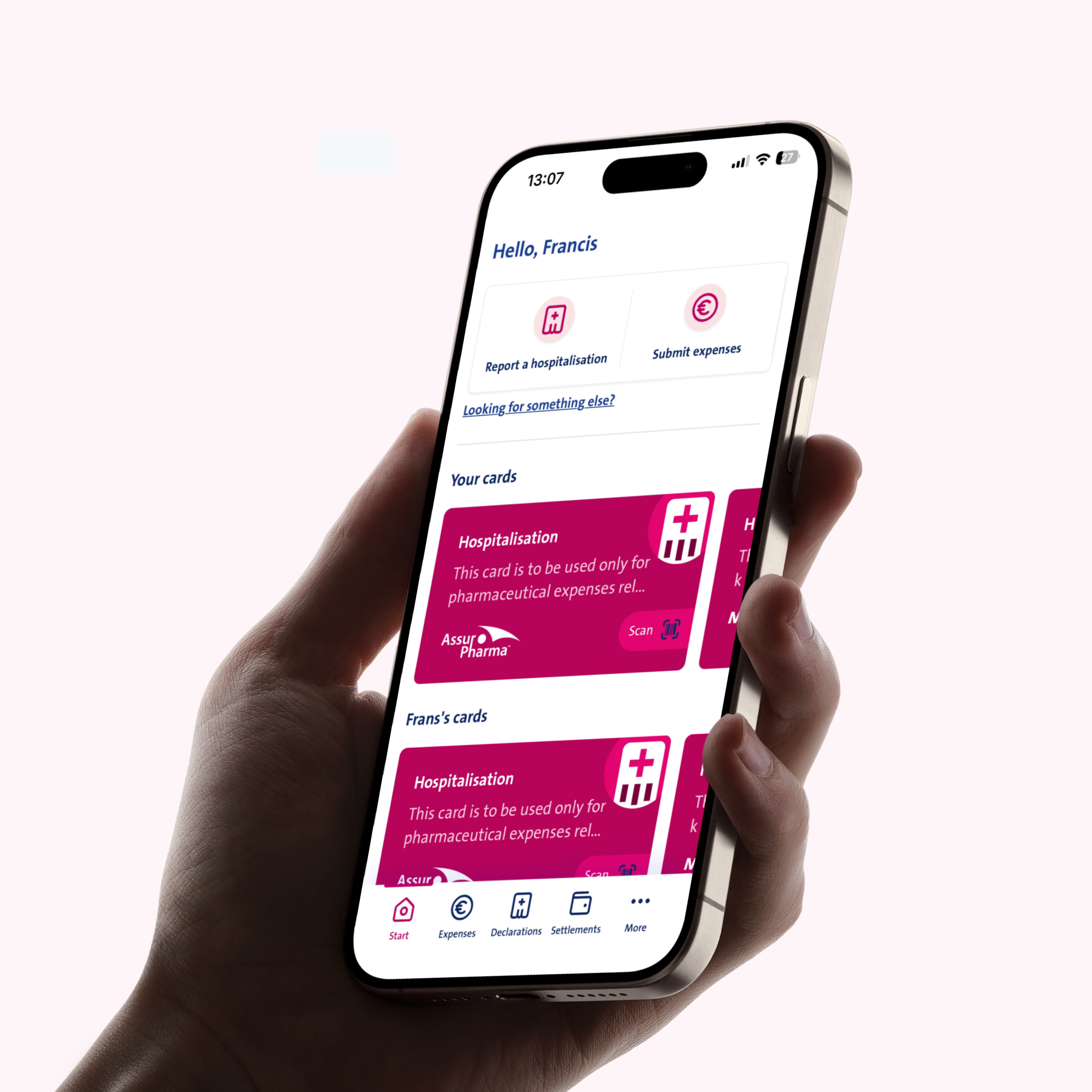

Your cards, always at your fingertips online

A single app for your 010 number and AssurPharma barcode

Medi-Link

Through the Medi-Link third-party payment scheme, your hospital bill goes straight to Vanbreda. Once you’ve reported your hospitalisation, we’ll handle the payment on your behalf. Make sure to provide your 010 number when registering at the hospital. You’ll find this number in the Vanbreda App.

Assurpharma

AssurPharma is the service that handles reimbursement of medication in Belgium. Ask your pharmacist to scan your personal AssurPharma barcode when purchasing medicines. Your pharmacy receipts will then be sent to us automatically for reimbursement.

Extra tips in case of hospital admission

.Always bring your ID card to hospital and make sure you have the Vanbreda App installed.

Always show your 010 number in the hospital (via the Vanbreda App)

Report your hospital admission online and track the status of your file directly in the Vanbreda App.

Additional expenses? Submit those easily via your app too.

Articles

Useful articles

Get started quickly with Vanbreda

Family & Life

3 min read

Pregnancy and childbirth

On this page you’ll find out how Vanbreda can support you and what you need to do to ensure your costs are reimbursed smoothly.

Hospitalisation

3 min read

Pre- and post-period

Support before and after your hospital stay.

Family & Life

4 min read

Fully insured while travelling abroad

Planning a trip abroad?

Frequently Asked Questions

Show allHospital admission

Your personal contribution (or copay) is a deductible that you must pay yourself for treatment or other expenses covered by your insurance policy. The amount of your personal contribution depends on the terms and conditions of your insurance. Depending on your policy, your copay is withheld either per policy year or per claim year (starting from the moment you submit your first claim or expense). Your personal contribution is deducted from the costs eligible for reimbursement until the maximum amount has been reached. The amount deducted as your personal contribution is always shown on the settlement note you receive from us. You can find a detailed overview of your maximum personal contribution in your policy terms.

Medi-Link is the third-party payment scheme of Vanbreda Health Care. Through this system, you don’t have to pay any bills or fees upfront directly to the hospital. Instead, we handle your hospital bill on your behalf through your insurance plan. Your hospital sends us the bill for your stay through Medi–Link. We then pay the covered items on your hospital bill to the hospital, according to the terms and conditions of your insurance policy. Afterwards, we’ll send you a settlement note.

How does Medi-Link work?

Before your hospital admission, please report your hospitalisation via the Vanbreda App or the web portal. Once your report has been approved, all you need to do is present your 010 number at the hospital. You’ll find this personal identification code for Medi-Link in the Vanbreda App. This way, we’ll receive your hospital bill directly, so you won’t need to pay anything upfront to the hospital. You’ll then receive a settlement note from us detailing any costs that aren’t covered by your insurance policy. You’ll only need to pay the amount that isn’t covered.

Please note: Medi-Link is used for the payment of your hospital bill only and does not apply to the reimbursement of outpatient expenses.

If your son or daughter is admitted to hospital, you may want to stay overnight with your child during their hospital stay. The stay of a relative in the room of a patient is called rooming-in.

Reimbursement of rooming-in depends on the terms and conditions of your insurance policy. If rooming-in is covered by your insurance plan, the reimbursed amount typically depends on the child’s age. There is often a restriction on the maximum number of days reimbursed or a maximum amount.

Does your policy cover rooming-in? Then submit your child’s hospital invoice, showing the rooming-in charges. Separate bills or invoices – for example, for hotel accommodation in the parent’s name – will never be reimbursed.

Les frais de séjour de votre conjoint durant votre hospitalisation ne sont jamais remboursés par votre assurance.

Non-medical costs are not reimbursed by your hospital insurance. Examples of non-medical expenses include personal care products or the cost of a partner’s stay in your room (rooming-in) during hospitalisation. You’ll find full details of eligible costs for reimbursement in your policy terms and conditions.