Redundancy or retirement: how to continue your insurance policy?

Have you changed jobs, retired, been made redundant, or experienced another change in your employment situation? There are several reasons why you might lose your enrollment in your employer’s group health insurance scheme. That’s why you have the option to sign up for an individual continuation of your insurance. In addition, you can use a so-called waiting policy to pre-finance a future individual insurance policy. On this page, you’ll find a handy overview.

Individual continuation of your insurance

If you lose your enrollment in your employer’s health insurance scheme, you’re entitled to continue your insurance policy on an individual basis. This also applies to any family members who were covered under the previous insurance plan. Provided you meet certain conditions, you can even continue your insurance without a waiting period or additional medical formalities.

Eligibility conditions for individual continuation

To continue your insurance individually, certain conditions apply. In the two years prior to the date on which you lose your group insurance enrollment, the principal insured person must have been continuously insured under one or more consecutive health insurance contracts with an insurance company.

Any pre-existing conditions that were already covered at the time of joining the employer’s health insurance scheme will remain covered under your new individual contract.

Which time limits and deadlines apply?

Are you the principal insured person?

If you lose your insurance provided by your employer, they must notify you within thirty days. This notification may be sent electronically or by post. You then have thirty days to inform us if you wish to continue your insurance on an individual basis (in full or in part). You may extend this period by another thirty days, provided you notify our Vanbreda team. You can do so either online or by post.

Please note: the initial thirty-day period starts on the day your employer informs you. The maximum deadline is 105 days after the day on which you lose your employer-provided health insurance.

Time limits and waiting periods for co-insured family members

The same time limits apply to insured family members as to the principal insured person, with one important difference. If a family member loses their coverage for a different reason than the principal insured person (for example, in the event of a divorce), a different deadline applies. In that case, the family member has 105 days to let us know they wish to continue their insurance individually.

What are the conditions of the insurance premium?

The terms and conditions of an insurance policy that you continue individually are the same as those of your insurer’s individual insurance contracts. The coverage and benefits provided are always equivalent to those of your employer’s group health insurance scheme. The premiums correspond to the premiums that applied at the time you lost your group insurance cover. Your individual contract starts at the moment you lose the benefit of your employer’s health insurance scheme. In principle, an insurance contract that is continued on an individual basis cannot be cancelled by the insurer.

Pre-financing and waiting policy: extra advantages

Premiums for individual insurance policies are typically higher than those for employers’ group health insurance schemes. This is why Belgian health insurance legislation provides a system of pre-financing. You may choose to pay an additional individual premium while you are insured via your employer. If you later choose to continue your health insurance individually, your insurance premium will be based on the age at which you started pre-financing rather than your age when starting your individual insurance plan. This additional premium is paid via a separate contract: the waiting policy.

Share this article

Ann Van Dijck

Healthcare expert

Did you find this a useful item?

No

Yes

Articles

Maybe these are something for you

We provide recommendations based on your recent actions on our site:

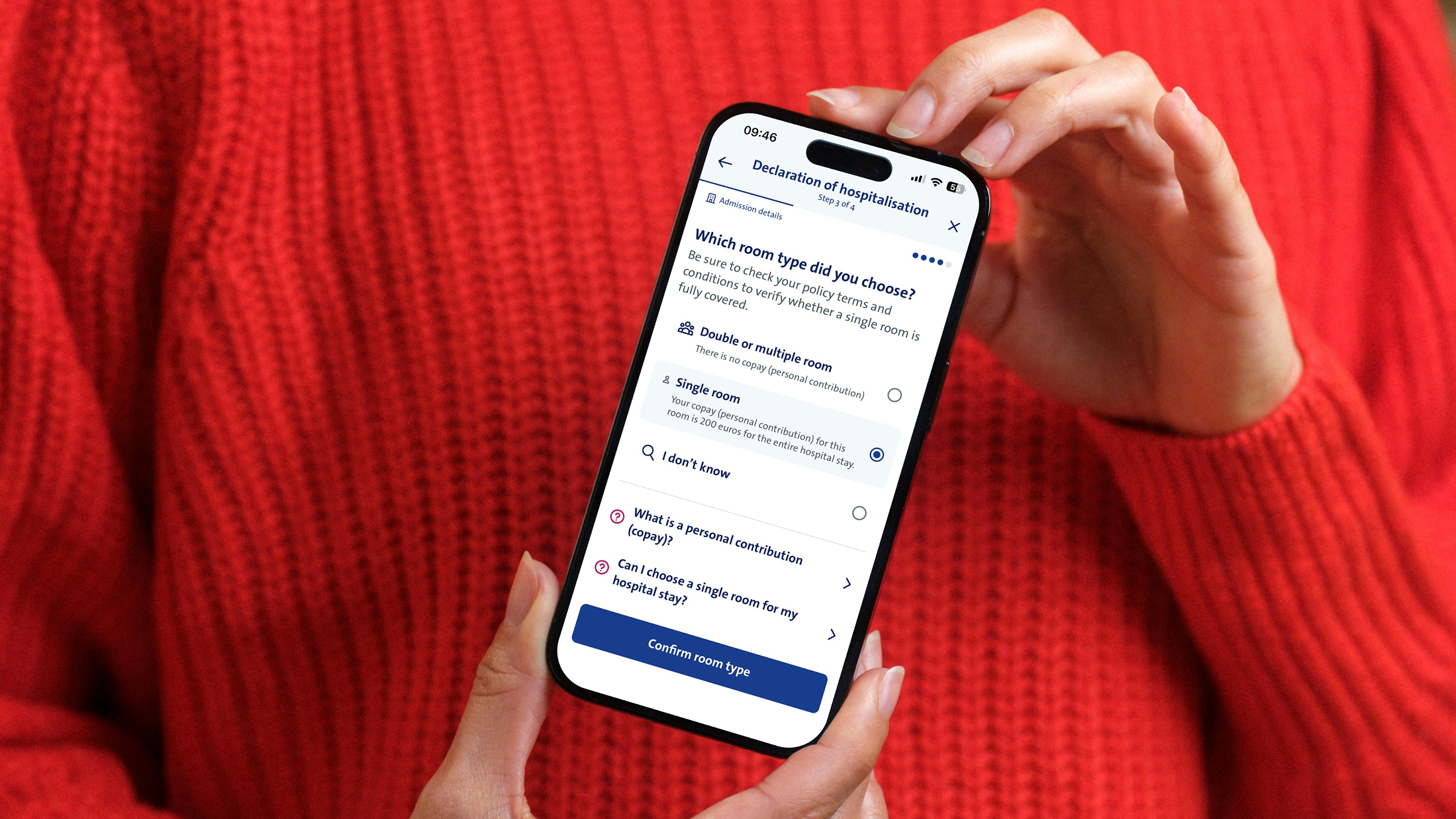

Digital

5 min read

December release update

We've launched a redesigned website with clear, relevant content and improved our declaration process to remove unnecessary steps for our customers & insured.

Outpatient care

4 min read

Physiotherapist visits

Do you need physiotherapy treatment following a hospital stay? On this page, you’ll find out how to easily submit your expense.

Family & Life

3 min read

Pregnancy and childbirth

On this page you’ll find out how Vanbreda can support you and what you need to do to ensure your costs are reimbursed smoothly.

Find answers to all your questions.

Take a look at our knowledge center, here you can find the most frequently asked questions.